Every business has its own billing process.Ī bill refers to providing evidence of a transaction to both the seller and the purchaser. As a form of payment, it is either printed or written out. Customers are likely to pay for things and services they obtain or utilize. In invoice and billing, The amount of money owed by a consumer to a firm is known as a bill.

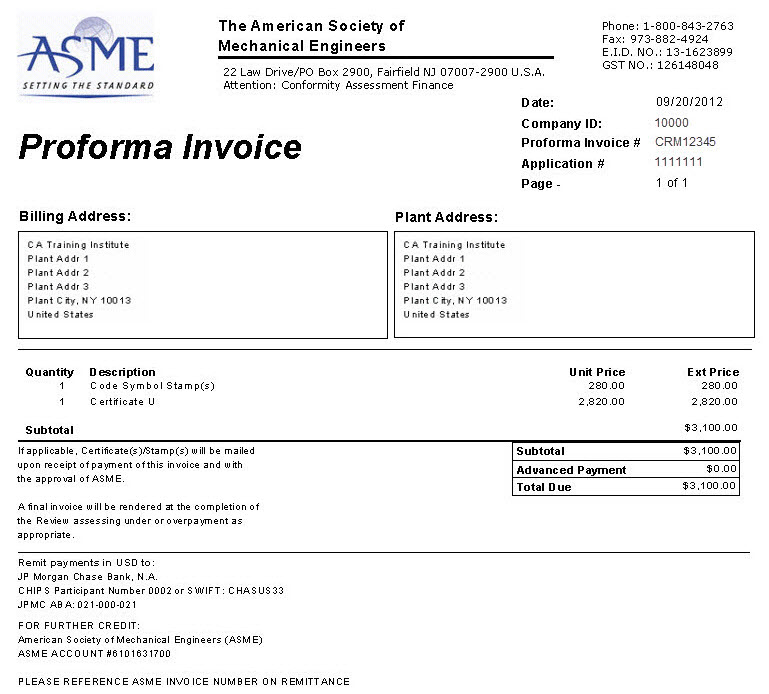

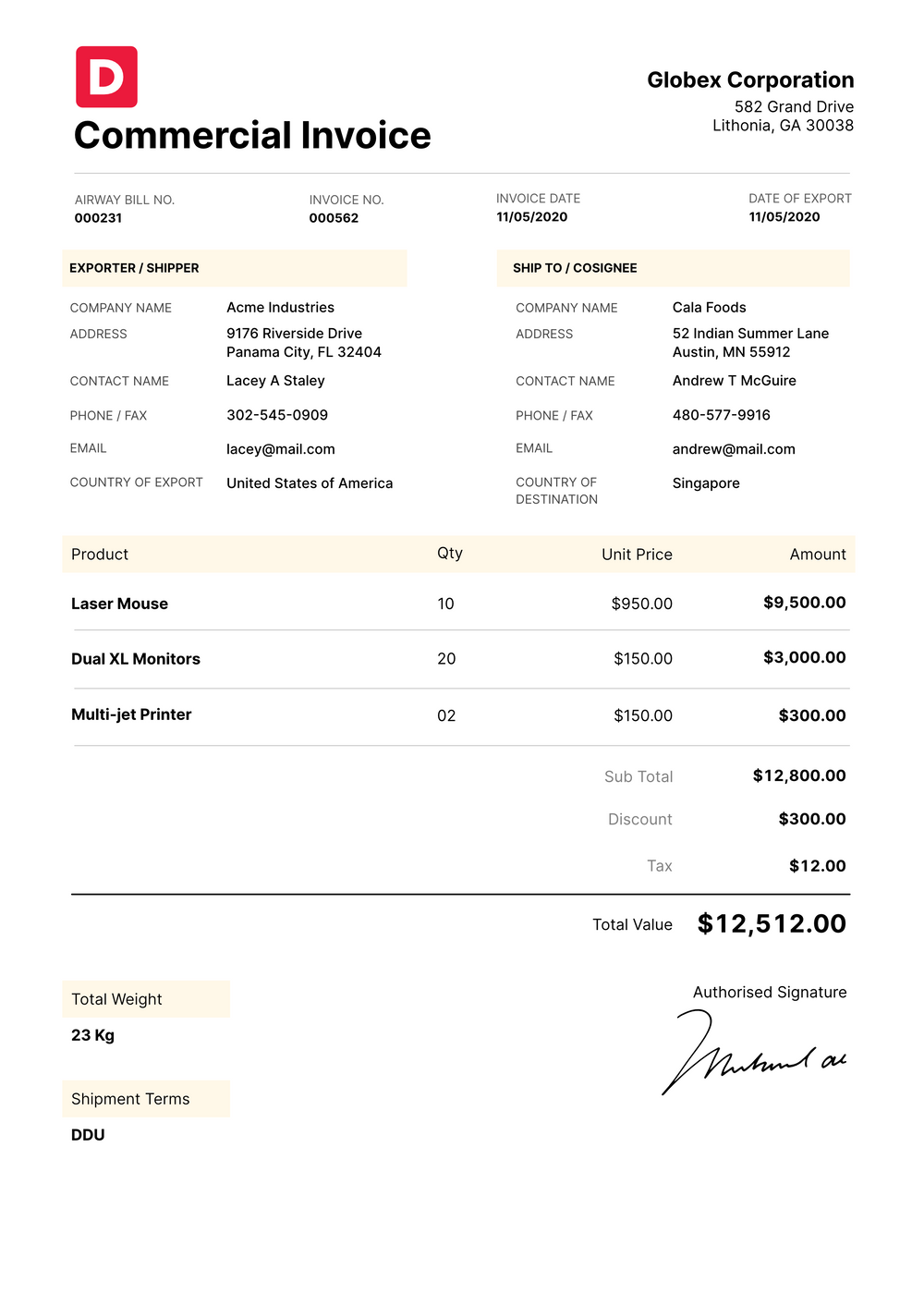

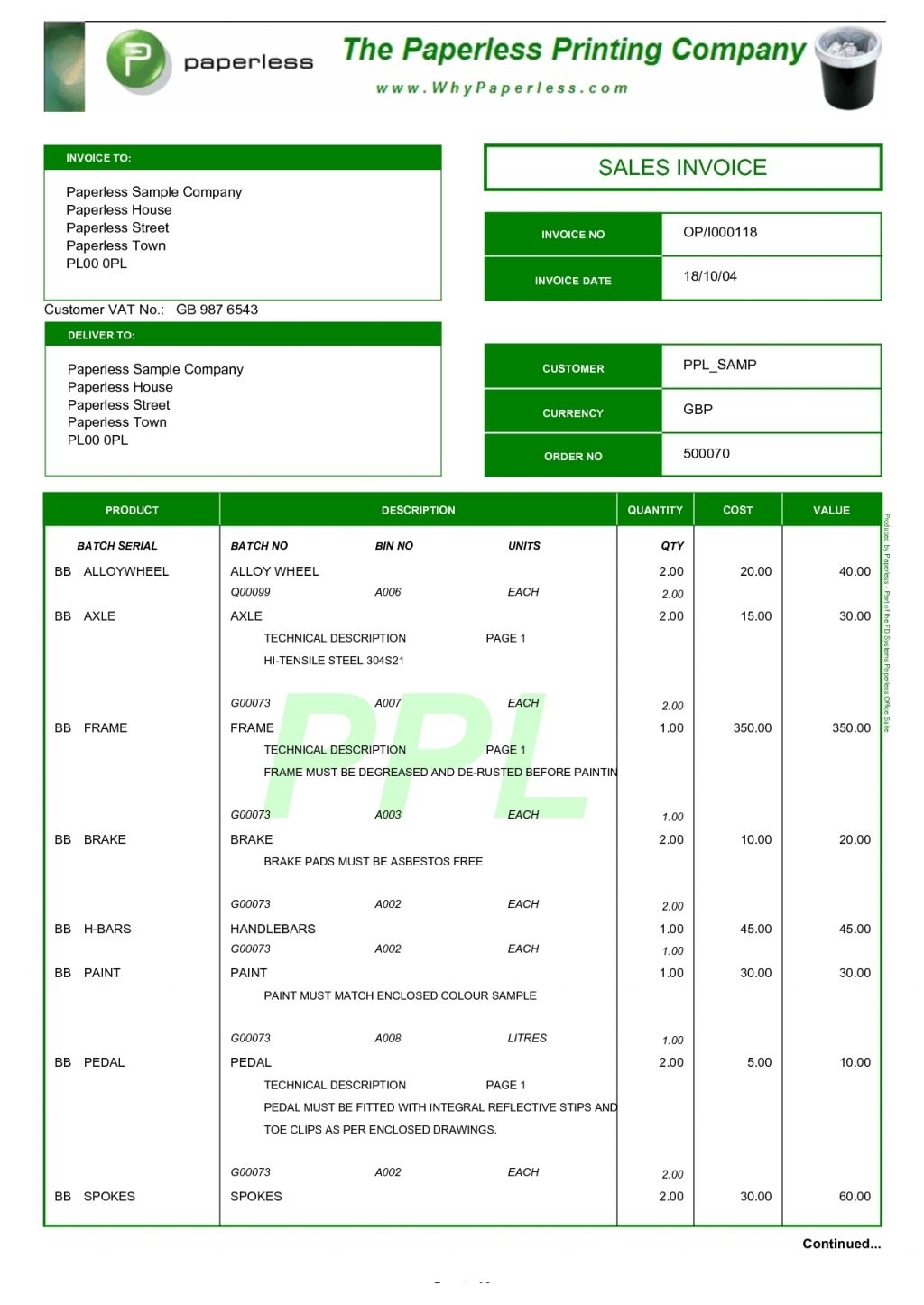

In the end, we can say that an invoice is a description of costs presented to the customer by the vendor (for a product sold or a service provided) What was delivered is listed and described, along with the customer’s due date and payment terms. An invoice records the products or services sold to the firm for accounting reasons.Payment is requested by issuing an invoice sent out before the money is received.When a firm asks a customer for money, it is through invoices.Invoices are also unique in that they show the existence of credit since the seller will not be paid immediately but at a later time. Since an invoice is a demand for payment, it’s usually sent after the acquired goods or service is delivered. When you send an invoice, you’re asking for money to be paid to you within a specific time frame, like within 15 days (What the customer owes to the business). The Oxford English Dictionary describes an invoice as “a list of items shipped or services rendered, with a description of the price payable for them a bill.”. Small businesses rely on invoices to be paid for their services, making them vital to their operations. In simpler terms invoice is a document requesting payment. Your client’s payment due date and the services you provided are included on an invoice. The accounting system and invoicing process of a small firm are built based on invoices. When it comes to invoice and billing, an invoice is a document that details the items and services a business gives to customers and who is responsible for paying for them against services provided. So, in this blog post, we will lay down the clear difference between billing and invoice.

Invoices definition software#

While reading this article, you still have a question: Is an invoice a bill? Or is an invoice the same as a bill? Does accounting software generate both? So, keep on reading to know the exact difference between an invoice.Ī misunderstanding might result in tragedy since it can cause anything from a bit of inconvenience to significant financial loss. Regarding billing vs invoice, it may be challenging to determine the distinction between the two papers and when to utilize each when you as a business request payment. Not only do business owners owe it to their clients but also to themselves to educate themselves on the financial instruments they will employ daily in a business transaction. Let’s investigate billing vs invoice in depth! It is necessary to understand these terms in order to receive immediate payment with respect to the services rendered. There are distinguishing qualities between the two, although they are roughly on the same trajectory. In the corporate world, bills and invoices are often interchanged. When it comes to billing or invoicing – most of us consider them the same.

Send invoices through the agreed-upon method.

Invoices definition manual#

According to a study by the Hackett Group, organizations that automate their invoice processing can see a 30% reduction in the number of invoices requiring manual intervention. Invoices should include, at the minimum:īecause manual steps and manual data entry are eliminated or reduced, the entire AP process becomes exponentially more efficient than manual invoice processing. Verify the contact information for each supplier and double-check this against your invoicing software.Įnsure that the e-invoice format you have chosen includes all necessary information. Confirm that they are willing to receive invoices in this manner.

The first step in getting started with e-invoicing is to communicate with your business partners.

0 kommentar(er)

0 kommentar(er)